Incident happen for penang flood in year 2017 cause RM 43.5 Mil claims.

over the years. about 38-40% claims incurred ratio.

Door Gift and breakfast meal.

AGM Summary

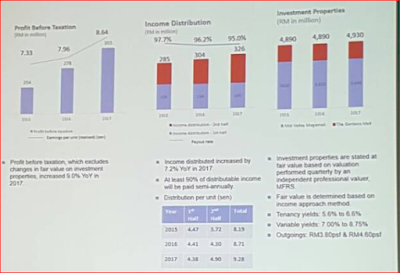

Overall company perform well in Y2017, and issue bonus share to increase the liquidity of the stock.

--------------------------------------------------------------------------------------------------------------------------

Some knowledge on Insurance Industry

On Insurance company evaluation,

The insurance industry can be broken down into two categories:

1)Life Insurance

2)Property and Casualty (P&C) Insurance

Life insurers underwrite policies that insure persons against terminal illnesses or death.

P&C insurers underwrite a myriad of policies that insure anything from car accidents and earthquakes to kidnapping and terrorism.

LPI only provide P&C Insurance.

Insurance Industry make money via 2 channel

1) Earning Premium (client pay premium for event yet occur)

2) Investment Income (Gain from Premium)

Important Evaluation Criteria would be

combine ratio = (Losses + Expenses)

Premiums

Eg. 1

combine ratio = (100 + 10)

100

combine ratio = 110%

*above 110% means making loss

Eg. 2

combine ratio = (50 + 10)

100

combine ratio = 60%

*below 100% means earning. The lower the better

In this case LPI perform well at combine ratio of 64%.

Others Financial EBITA, working capital,capital expenditure not suitable for insurance as the nature of business is earning premium in debt and gaining from investment. so as long as peace nothing happen insurance will continue earn more.