Top 3 Target

1. Healthy First. world come later. / Learned Yoga need more persistence practice.

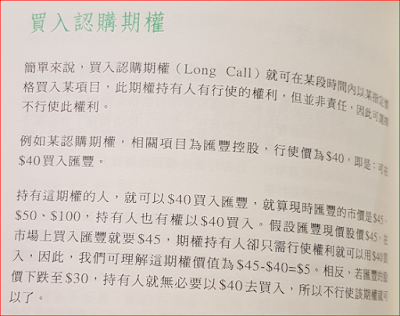

2. wealthy. Try out new method to generate income. / learned option method to generate income.

3. Personal life. / still need to develop hobby and enrich life.

Long term Target

1. Purchase property in year 2017 to generate income.

/ Not done. as overall debt at current year is still huge. got to be align with 3 years planning.

2. Dividend income(Fund allocate 200k) reach

2.1 RM 10k. per year / RM 833 per month / 0.05% - First Target

2.2 RM 12k per year / 0.06% - Second Target

2.3 RM 14k per year / 0.07% - Third Target

/ Not successful.overall archive about 8.9k per annum only.

due to the diversify on the direction of capital gain versus dividend play is major issue on stock pick.

3. Equities gain to cover year 2014,2015,2016 losses.

/ Not Successful. as of 2017 there is several stock overall bring down the performance as Nov 17 there have been correction on KLSE.

4. Healthy via sport. weekly need 2 - 3 times.

/ Partially done on sport. still need more determination to push forward.

5. Monthly at least 1 book. per year 15 Book.

/ Partially done. Total 9 book have read and reviewed.

2016 - 7 books

2017 - 9 books

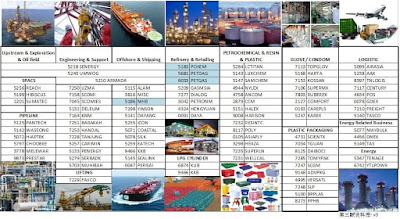

6. Portfolio healthy. to diversify not only MYR but different currency to maintain a stable portfolio.

/ Done. Diversify into 4 market USD, SGD,HKD, MYR. but as fund size not that big need not too diversify.

7. Weight to reduce. increase muscle Vs Fat. (refer to health report.)

/ Not improve. as lack of sport. cholesterol is still high as usual.

8. Move into US Stock.

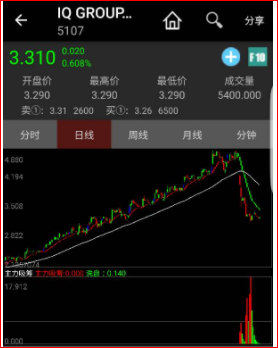

/ Done. explore new stuff on option trading instead of merely investing only.

9. Re-balance on portfolio and currency.

/ Done. as similar to items 6.

Things to be done.

1. Seek hk trading platform to reduce dividend cost / to be done on jan 18.

2. Better in manage property. property management / still not done.

6. Learn skiing / to be do on travel.

9. Explore for on9 trading opportunity./ not done.

11. Manage rental and Tax/ Rental not. Tax rebate considered in 3 years planning.

Results

6 out of 11 items done in Year 2017. Remaining issue or items not willingness or hard to complete.

Summary on year 2017

Relatively a better year compare to 2016 as stock increase much from Jan 17 till Oct 17. Correction happen around Oct 17 and Nov 17. but others Nasdaq and HKEX is doing well. KLCI still remain weak on stock pick. and the method shall be much on investing rather than trading for KLCI.

Trading on option appear to be better choice but loss on time as started on US stock around Jun 17 but start to much trading on option around Dec 17. loss on time period about 5 months time as delay is study about option trading. still much to learn and gain from option.

individual not much differences as still healthy items yet to be done. and directional to be more firm.

work wise not much difference as expect to change job in 2018. on the financial management blindness improve as debt and cash flow added into consideration rather than just calculating on assets only.

Not travel much on this year shall be due to time and did not planned well, with year start on car accident and gf accident which cost a lot of time to heal and recover. believed better year should be ahead. Planning wise consideration have change from year to year basis become 3 years and future should be on 5 years basis. think and plan for longer term instead of short period to clear direction better.

Lesson learn on mistake make and failure list is maintain for future as well. to remind and record of mistake done. Macao need to be updated as no news since the payment done.

On year 2018 to be better predict what is the possible happening for future market with the calendar on major event that impact the market or bring disturbance to the world.

to see further and wider on the world and market and prediction and most important ACTION to gain from it. on risk wise this year had diversify rather on single currency risk.

new quoted

“The Ferrari is a dream - people dream of owning this special vehicle and for most people it will remain a dream apart from those lucky few.” - Enzo Ferrari

wish me to be the lucky few instead.

Farewell on 2017 as time never return. it is straight line; embrace on Year 2018.