1) Consumer Industry

2) Manufacturing Industry

3) Construction Industry

4) Finance Industry

5) Property Developer Industry

6) Plantation Industry

7) ACE Industry

1) Consumer Industry

- Consumer goods related to daily living of citizen, so it very related to disposable income of people.

if economy good. consumer goods good sales. profit up. share price will up.

- Choose those with strong branding, have big market share, industry top player such as Nestle, Dlady, Heim , Carlsberg , Ajinomoto.

- Choose those provide daily necessary such as NTPM , Mflour.

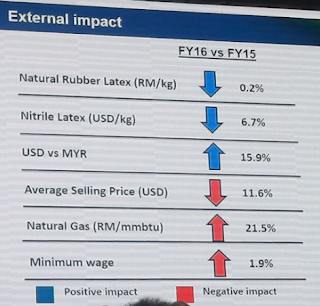

2) Manufacturing Industry

- this industry is very impact by big environment and always have economy cycle.

- Choose player that have high efficiency and low operation cost and strong cash flow.

- Choose when cycle down, and price share below half of NTA or 1/3 of NTA.

- Choose those with Strong cash flow during the down cycle.

3) Construction Industry

- Very much impact by government project, and construction take long time to complete and tender normally take long process.

- Choose those with strong brand and good cash flow such as Gadang.

4) Finance Industry

- Finance industry bank is control by BNM, so the profit is plus minus 1.5% range. so safety is important for bank industry to avoid bad debt.

- Choose bank that is caution and creditable.

5) Property Developer Industry

- to build a house need development, normally 1 Hectare is 2.47 Acres. 1 Acres is 43.5k sqft.

1 Acres can build about 10 double story house, if low cost house can build 14 to 16 house.

normally only 60% of the land can be use to build house, remaining will be use to build facilities such as road , electrical, piping etc..

- to build a house cost about 2 years, and provide warranty after build for 2 years. so actually about 4 years only can consider done for 1 project.

- Normally house Gross profit about 25 - 30%. so depends on the land bank buy when and pricing of the house if went up. Normally is a project able to sell 70% above consider is profitable already.

- Most profitable is build shoplot because less quantity, 1 housing area about 7% can be use to build shoplot only.

- Choose player that have alot of land bank and good location of land bank.

- Choose strong cash flow company and healthy company

- Avoid those company with a huge land bank and profit but not willing to share with minority shareholder.

6) Plantation Industry

- Plam oil industry depends on commodity price, like CPO. if CPO up the industry will earning.

- Normally 1 hectar of palm oil can output 21 ton of palm oil per year, if lower means efficiency low.

- evaluation is base on per hectar plam oil less than RM 30k.

- plam oil tree after 5 years produce palm oil, 7 - 18 years is mature and high production.

- Choose those palm oil company with high immature tree as this is future growing engine.

- Palm oil company also have another asset which is land if the land develop and convert to property will be earning more.

7) ACE Industry

- ACE industry no need focus on NTA, shall focus on the services and idea provided. focus on services provided.

Some stock picking in different country as below

1) US Market should pick technology and medicine.

2) Singapore Market is services

3) Malaysia Market is Plantation and Manufacturing.

4) UK Market is finance.