Profile Assessment

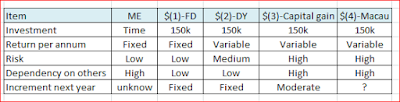

Refer to table below

Findings

From the table above, some unexpected findings or known but not aware of which is my own input for time and work is indeed much high dependency on others and increment on next year also is might as well unknown. Effort could be taken if may such as change work for higher income. But continuous changing of work apparently is not practical as well. concerning habit and behavior to stay in comfort zone.

well, unlike the others which is different type of capital assets, which is seem to be much more productive in compare. such as the capital no need to rest or sleep and it can keep on growing.

just depends on which type of capital will bring different kind of results back. so the strength to use $ to earn $ is much more feasible in compare to me earn $. pretty unexpected outcome.

of cause different type of return will bring back different type of risk. so it can be conclude such that risk is live within our life. one can't avoid from it. even you not risk taker, but u risk being taken over by others.

Conclusion

If things is shown as above, then i shall be much reorganized on the effort to be put into. indeed of i put 100% effort into the Me or Paid job. might as well spend more time on capital. since capital return is much more reliable than current Me paid job. as i totally can't control if next year will got any additional pay or bonus etc... although it seem non sense but indeed we live in a very weird world, where hard work people pay less; while risk taker earn more. world have moving to US style where "winner take all"

Thursday, July 27, 2017

Monday, July 24, 2017

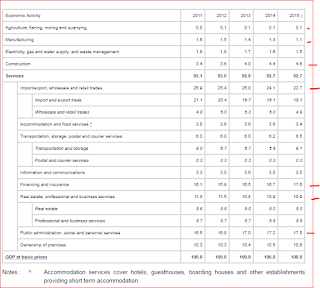

GDP Comparison

GDP of the preference country

1st Rank is Manufacturing which is unexpected at all follow by business services and finance services. but what is business services?

Thursday, July 20, 2017

Currency

Currency/Money

Recently after view the documentary from 大型纪录片 货币

got some idea of what is currency in actual.

Firstly will be the money from government come from where?

there is 3 channel the money come from.

i) From tax impose on citizen

ii) Issue Government Bond

iii) Print Money

Out of this 3 method, the best and easier method to be use will be print money. this apparently is favorite choice for government as it has the most immediate effect on the economy as well as slowest side effect on the economy.

but when there is more money being printed it cause inflation. inflation is a monster that create imbalance between rich and poor people.

for example asset price increase due to inflation but the asset itself did not generate or create any benefit or usage to economy but those who own asset will earn from it due to inflation. but those who work hard will be suffer due to inflation as original 1 dollar could buy a single bread will cause 2 or 3 dollar after inflation.

there is another assumption such that inflation give opportunity for those investor or risk taker to become sudden rich while those worker who work hard for living will be suffering most. it bring rich become richer while poor become poorer.

in history there is a lot of inflation over happen during the past and all have bad ending. so to keep alive one shall at least target to beat inflation in order to stay alive or sustainable.

we live in a strange world where the risk taker earn more than those who work quietly.

Friday, July 14, 2017

Intrinsic Value of a Stock

Intrinsic Value of a Stock

Offen i curious how to calculate a intrinsic value of a stock,below some example copy from invest smart.

On the PE it self, it is need to be more

careful to just fix any PE. indeed what is the normalized PE it should be. i

think much related to industry and market willing to give what PE. better way

may use the Top and Lowest PE and get a mid range and some reasonable

adjustment.

On this review could be 1 of the similar

example. but indeed shall more focus on the growth it can archive. for mature

bank seem not much can be growth. buy on weakness for blue chips stock. as blue

chips bank die means economy died.

this is a good example of strong cash flow

position. which means the cash flow generate from operation is the best. to

find out check the Quarter report or annual report on the Net cash flow

generated,

Weak cash flow is borrow money

from credit company to run operation which will incur a huge cost of interest.

but suitable borrowing is good depending on the nature and cash flow

management.

Summary

Apparently this is much simple

way of calculate intrinsic value. anyway focus on growth is much more important

and growth is hard to be measure.

Tesla chart 14 July 2017

Tesla chart 14 July 2017

Mock Test

base on the chart above. although the chart pattern similar to NVDA but the results totally different. Tsla chart did not able to break up. maybe due to gap down too much. from point A is similar as NVDA but when it side way 2 day and start to go up immediately on 2nd candle become star/doji. and 3day have move downwards.

Future most likely wil go down trend to previous support.

Comparison with NVDA chart.

very strong instead.

Mock Test

base on the chart above. although the chart pattern similar to NVDA but the results totally different. Tsla chart did not able to break up. maybe due to gap down too much. from point A is similar as NVDA but when it side way 2 day and start to go up immediately on 2nd candle become star/doji. and 3day have move downwards.

Future most likely wil go down trend to previous support.

Comparison with NVDA chart.

very strong instead.

unlike Tsla . NVDA was gap up during the trend. i guess this is the major diffrent between this 2.

gap up show momentum much strong to move upwards.

but it have reach peak with all time high. short term expect to rebound. shall consider to enter again once it start momentum again.

Tuesday, July 11, 2017

Failure list in 2017

Failure list in 2017

To record down items failed after try out as a reminder for future.

Summary

1) FD usage mistake. low efficient.

2) FD long term. lack of forex risk awareness.

3) hold too much of FD. incur loss on potential gain

4) Force trade. incur high risk on stock trading.

5) AEONCR - ICULS - mistake on not aware conversion only at ICULS not ICULS plus cash

6) IQgroup - Mistake on chase high. ignorance or too optimistic on the QR results. but end up results poor for 18Q1. however based on the industry review is still optimistic.

7) Hevea - Mistake on not sell when signal show trigger cut loss.

8) Too calculative on minor forex loss and lets go of big bull trend in USA.

9) Mistake trade on option without consider cover stock, the advantage will be on time decay.

1) Year 2015 and before did not pay attention on capital efficient while a much capital was just put into Fixed Deposite (FD) for the fixed interest. FD was put in per month. instead of a longer term was due to think of may use the capital soon. but in fact after a year this capital was not used.

Mistake - did not use capital efficient. ; Revision - capital was into longer term instead of one month only.

2) Following with the FD from month to longer term per half year or per year according to promotion available during 2016. however find out that the much FD was place indeed the much capital was depreciate as during this time, MYR was deeply depreciated against USD. this make me awake that importance on diversify on Forex risk. it was just like i did nothing wrong but i was punish with penalty on my money due to mistake done by government.

Mistake - did not diversify forex risk even after 2015 first depreciation of MYR ; Revision - suitable adjust forex risk to mitigate a deep drop in single currency again.

3) FD yearly or half year did not bring much capital gain. during recession time shall buy more blue chips stock and hold. wait for recovery and earn much capital again.

Mistake - afraid of buying stock, just want safety of FD but indeed loss on best time capital gain opportunity ; Revision - each time recession is good time to buy and hold.(to remind the future me when i see this again)

4) Force my self to trade. 2017 was force trade on my self looking at the Nasdaq was breaking new high, rational tell me not to chance high but was failed to emotional and greed and chase high. end up was stuck at high price. i totally forgot US stock are applicable for put option as well.

Mistake - force trade. can hold on capital ; Revision - trade plan shall be available and trade base on plan.

5) AEONCR -LR or ICLUS was a mistake as not aware on the conversion can only be made by using ICULS means at conversion price of 10.99 1 need to have 11,000 ICULS only can convert into ordinary share. also there is alot of hassle to go get bank draft and post to registar etc. original was thought it can be ICULS + cash but appear only can convert by ICULS only.

6) IQgroup - Buy or chase high, QR show poor results. market drop 21% directly incur loss immediately. shall not chase high or over optimistic.

7) Hevea - did not sell when signal have trigger to cut loss. due saw EPF buy in during the period also did not willing to acknowledge on the statement hevea earning potential is impact as mentioned by the MD. price drop below and incur losses.

8) Year 2016 MYR bid drop and delayed my plan to convert MYR to USD in wish to start on USA stock, the rate exchange was indeed minor in compare to the bull trend that Nasdaq have created. too calculative on small money and lets go of big money.

9) Option trade on NVDA mistake on selling option too rush with short time decay. and too low strike price. create problem on both strike price and premium earning.

the mistake cost USD 75.

Problem is not take full simulation or consideration on the asset underlying if wish to continue hold using margin or sell out while take higher premium with longer time line.

trade details as below.

Lesson

consider carefully on asset holding or the stock trending moving onwards. if on downtrend should sell it with having higher possible premium. else should take lower premium with less chance of exercise.

To record down items failed after try out as a reminder for future.

Summary

1) FD usage mistake. low efficient.

2) FD long term. lack of forex risk awareness.

3) hold too much of FD. incur loss on potential gain

4) Force trade. incur high risk on stock trading.

5) AEONCR - ICULS - mistake on not aware conversion only at ICULS not ICULS plus cash

6) IQgroup - Mistake on chase high. ignorance or too optimistic on the QR results. but end up results poor for 18Q1. however based on the industry review is still optimistic.

7) Hevea - Mistake on not sell when signal show trigger cut loss.

8) Too calculative on minor forex loss and lets go of big bull trend in USA.

9) Mistake trade on option without consider cover stock, the advantage will be on time decay.

1) Year 2015 and before did not pay attention on capital efficient while a much capital was just put into Fixed Deposite (FD) for the fixed interest. FD was put in per month. instead of a longer term was due to think of may use the capital soon. but in fact after a year this capital was not used.

Mistake - did not use capital efficient. ; Revision - capital was into longer term instead of one month only.

2) Following with the FD from month to longer term per half year or per year according to promotion available during 2016. however find out that the much FD was place indeed the much capital was depreciate as during this time, MYR was deeply depreciated against USD. this make me awake that importance on diversify on Forex risk. it was just like i did nothing wrong but i was punish with penalty on my money due to mistake done by government.

Mistake - did not diversify forex risk even after 2015 first depreciation of MYR ; Revision - suitable adjust forex risk to mitigate a deep drop in single currency again.

3) FD yearly or half year did not bring much capital gain. during recession time shall buy more blue chips stock and hold. wait for recovery and earn much capital again.

Mistake - afraid of buying stock, just want safety of FD but indeed loss on best time capital gain opportunity ; Revision - each time recession is good time to buy and hold.(to remind the future me when i see this again)

4) Force my self to trade. 2017 was force trade on my self looking at the Nasdaq was breaking new high, rational tell me not to chance high but was failed to emotional and greed and chase high. end up was stuck at high price. i totally forgot US stock are applicable for put option as well.

Mistake - force trade. can hold on capital ; Revision - trade plan shall be available and trade base on plan.

5) AEONCR -LR or ICLUS was a mistake as not aware on the conversion can only be made by using ICULS means at conversion price of 10.99 1 need to have 11,000 ICULS only can convert into ordinary share. also there is alot of hassle to go get bank draft and post to registar etc. original was thought it can be ICULS + cash but appear only can convert by ICULS only.

6) IQgroup - Buy or chase high, QR show poor results. market drop 21% directly incur loss immediately. shall not chase high or over optimistic.

7) Hevea - did not sell when signal have trigger to cut loss. due saw EPF buy in during the period also did not willing to acknowledge on the statement hevea earning potential is impact as mentioned by the MD. price drop below and incur losses.

8) Year 2016 MYR bid drop and delayed my plan to convert MYR to USD in wish to start on USA stock, the rate exchange was indeed minor in compare to the bull trend that Nasdaq have created. too calculative on small money and lets go of big money.

9) Option trade on NVDA mistake on selling option too rush with short time decay. and too low strike price. create problem on both strike price and premium earning.

the mistake cost USD 75.

Problem is not take full simulation or consideration on the asset underlying if wish to continue hold using margin or sell out while take higher premium with longer time line.

trade details as below.

| 12/26/2017 9:03:57 AM | tAndroid SOLD -1 NVDA 100 (Weeklys) 29 DEC 17 202.5 CALL @.21 MIAX | ($2.95) | $21.00 |

| 12/27/2017 8:43:10 AM | tAndroid BOT +1 NVDA 100 (Weeklys) 29 DEC 17 202.5 CALL @.90 NASDAQ | ($2.95) | ($90.00) |

consider carefully on asset holding or the stock trending moving onwards. if on downtrend should sell it with having higher possible premium. else should take lower premium with less chance of exercise.

NVDA Option Trade Review July 2017

Trade review on July 2017 NVDA

As shown on above chart is Day chart.

1st Option purchase on 23 Jun 17(label B). is about drop after 4 days saw a green candle rebound.

when purchase end of trade day it become hammer and next day after keep drop for another 3 days.

the portfolio in short turn become >80%. sell on 10 July 17. (5% profit)

Review back

the purchase on this is risky as purchase on the first rebound. but catch up in the mid of down trend.

shall wait for 2nd candle to be clear on the trend direction before buy in.

2nd Option buy on 7 July after 2 days of side way. No further drop beyond the red candle. and start to trend up. Sell on 10 July 17. (22% profit)

Review back

Too urge to sell even after gap up trend is shown. normally gap up will lead to higher up trend. mistake on this is sell too soon. but due to the up almost near to recent resistance. may consider wait for another day to decide if to sell out.

As shown on above chart is Day chart.

1st Option purchase on 23 Jun 17(label B). is about drop after 4 days saw a green candle rebound.

when purchase end of trade day it become hammer and next day after keep drop for another 3 days.

the portfolio in short turn become >80%. sell on 10 July 17. (5% profit)

Review back

the purchase on this is risky as purchase on the first rebound. but catch up in the mid of down trend.

shall wait for 2nd candle to be clear on the trend direction before buy in.

2nd Option buy on 7 July after 2 days of side way. No further drop beyond the red candle. and start to trend up. Sell on 10 July 17. (22% profit)

Review back

Too urge to sell even after gap up trend is shown. normally gap up will lead to higher up trend. mistake on this is sell too soon. but due to the up almost near to recent resistance. may consider wait for another day to decide if to sell out.

Monday, July 10, 2017

Dilemma: Emotional Vs. Rational Investing

This topic is much relevant and catch my attention on my weakness and issue facing all the while.

all the while the trading and investing method and ideology is totally wrong. miss out what is trading and what is investing method.

1) Trade and Invest differences

The problem is most of the time want to do trading but spend all time go thru financial report or QR.

trading shall be straight forward. focus on momentum and strength only.

Investing shall be long term and fundamental base. shall refer to intrinsic value not the price it seem.

confuse among these 2 will resulted in loss.

2) Shall have a trading journal to monitor and record down each trade and review on the reason buy/sell and lesson learn.

Benefit

1. Uncover patterns

2. Avoid repeating mistakes

3. Identify weakness and strengths

4. Know your emotional state - greedy, fear, clueless,panic?

5. What could have done better ... e.g. put a buy/sell stop limit

6. Enable you to develop a unique trading system/strategy that is suitable for your trading habits, behavior and personality

3) To mitigate this emotional things.

1st Method is Buy and sell in stages

2nd Method is Earning Yield = Earning Per Share / Current Share Price

3rd as below, review performance periodically and re balance if needed.

3rd as below, review performance periodically and re balance if needed.

Subscribe to:

Comments (Atom)