http://www.annjoo.com.my/investor-relations/latest-news/

The info from Ann joo it self.

we can observe that the recent QR drop was due to higher material cost on scrap as well higher cost on the production from furnace it self. All raw material pricing have gone up.

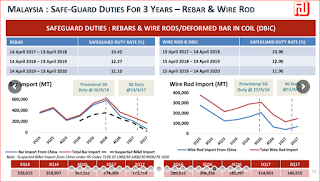

the advantage is now the pricing in Malaysia is much lower than produce in china due to china decision to reduce production of steel and environment concern. refer as above the pricing in Malaysia is much lower some more there is exercise duty impose on steel imported. Due to this the import qty is much lower in compare to last few years.

Now there is export opportunity for Ann joo as most of the ASEAN country also developing and require a lot of steel product for infrastructure.Expect the coming Quarter Results,Q3 will be good.