Masteel - 11 Sept 17

The review done on 11 Sept 17.

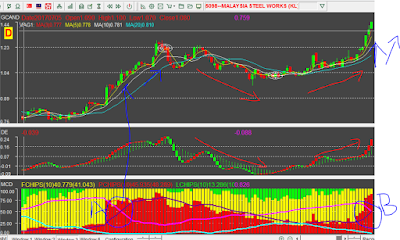

Chart 1

on the short term the stock break thru the near term resistance of 1.27.

but the last candle show no head and tails.

means the uptrend strength have weaken.

but on the MCD part, the purple line is upward cross pink line.

indicate there is further uptrend in the near future.

Chart 2

indicate the all time chart the highest point is around on 2008 year. around 1.2.

current price have break thru all time high.

if can persist it shall indicate 1 time return from the box space.

the buy point shall be the retreat of the current pricing and not supported at the resistance.

Chart 3

From the deviation expert shows that the fund inflow is align with the stock performance.

point A show the last time purple line upward cross pink line with red candle at 75% above stock price still able to go up. point B is exactly same as point A also with red candle > 75%(slightly higher than point A)

Conclusion

when the price fall not and supported at 1.2 then can consider good point to enter. price have break thru all time high. there is no resistance.

Chart 1

Chart 2

Chart 3

No comments:

Post a Comment